Home Loan Offset Accounts can save you money on a home loan, but only in the right circumstances.

It is very common for people to have heard from friends or parents that an ‘offset account’ is the go these days as it helps you save on interest repayments. But is an offset account worth it? Should you go with a savings account or offset mortgage?

Offset accounts are worth it, to a degree.

Offset accounts are great when you are:

- Borrowing a lot of money; and / or

- For those with a big chunk of savings or equity in their home; and/or

- If you are a good saver.

But unfortunately, most first home buyers don’t fit this profile.

Having a home loan with an offset account may mean that you pay an annual fee of several hundred dollars a year and you may have a higher interest rate on your home loan.

So you need to understand if you are financially better off – or not – paying for it.

The cost to someone who makes this mistake can range from hundreds to many thousands of dollars a year.

Victor Kalinowski, Mortgage Broker at Blackk Home Loans. I talk all my clients through the in’s and out’s of offset accounts so you’ll be really clear on whether they are for you, and how to optimise one.

Offset account meaning: What is it?

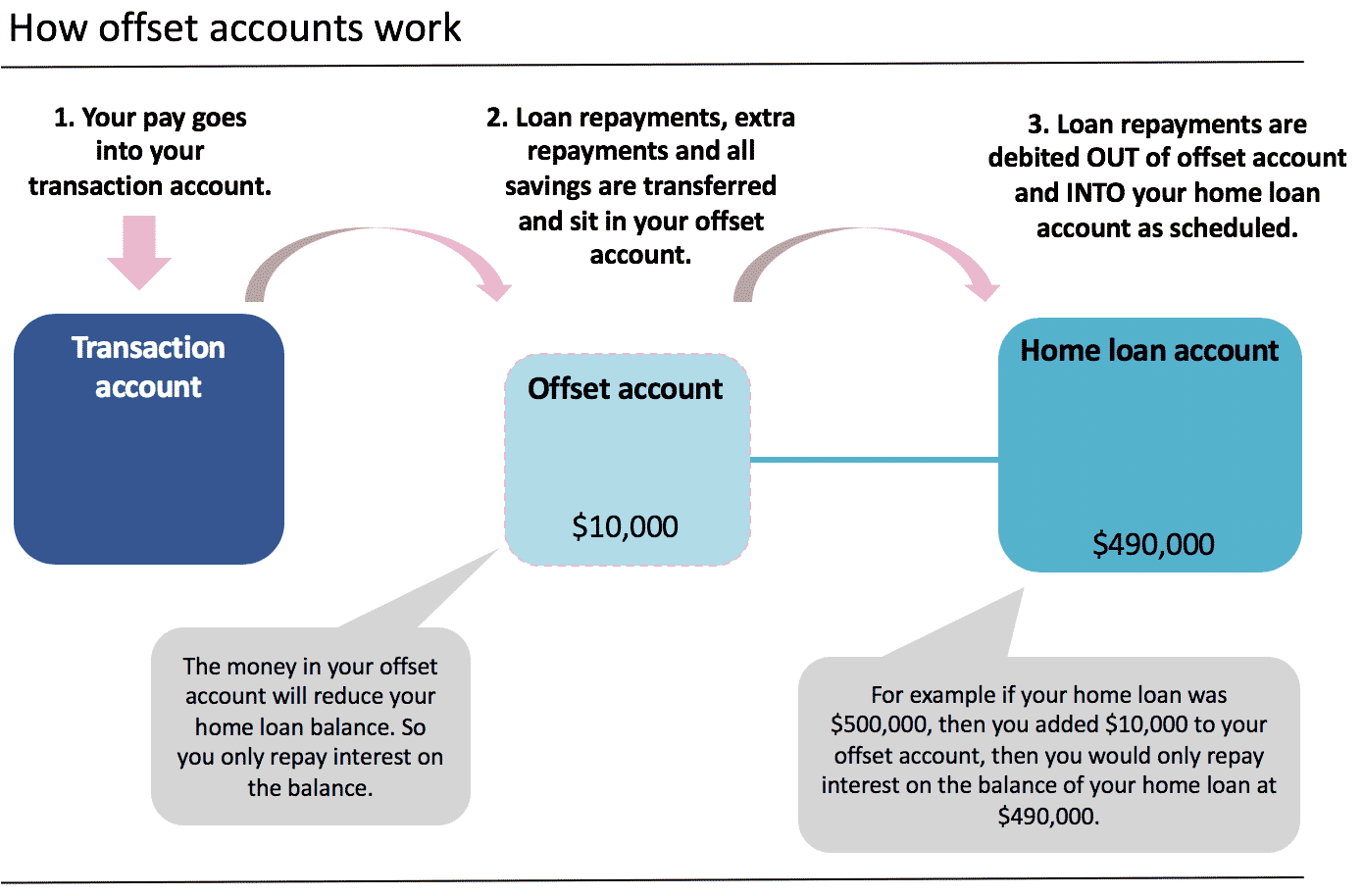

An offset account is usually a transaction account that is linked to your mortgage. Any money in the account reduces your mortgage debt balance so that you end up paying less interest on your home loan.

You would keep your money / savings in your offset account instead of putting it in a high interest saver account because the interest rate on your home loan is higher than the one on your high interest saver.

Table 1: Offset accounts save you money by reducing the balance of your home loan.

How to Make The Most of Your Offset Account

Case Study – How do you work out when it’s worth paying for?

This couple are buying their first home which is a townhouse in Greenslopes;

- Townhouse purchase price – $468 000;

- Deposit saved to contribute – $43,600 (8%);

- Home Loan / amount to borrow – $430,650 (92%)

After some research and analysis, I narrowed their home loan down to one bank which best suited their personal circumstances.

These are the two home loan options available with this bank:

| Extra Features | Variable Interest Rate | Annual Fee | Weekly Loan Repayments | |

|---|---|---|---|---|

| Option 1: Basic Home Loan | none | 3.89% | $0 | $481 |

| Option 2: Package Home Loan | Offset account, redraw, credit card | 4.32% | 395% | 507% |

Table 2 – A comparison of two different home loans, showing the extra costs associated with having an offset account and the ability to redraw your money 📟.

The Basic Home Loan (Option 1) with no offset account or redraw, has lower weekly loan repayments ($481 v $507) because of the lower interest rate. Over the year, this is $2,295 less in interest repayments.

This means, if you were to go with option 2 which has the offset account – the offset account would need to save you at least $2,295 in interest repayments (make that almost $3,000 by the time you add on the annual fee of $507) a year to make it worthwhile.

I won’t over load you with calculations, except to say that you would need to have a minimum of $50,000 of savings sitting in your offset account for at least one year – BEFORE it outweighs benefits of going with option 1 the basic home loan.

Now we’ve helped a lot of first home buyers and people looking to refinance..

It’s often just unrealistic to have a spare $52,500 saved to sit in an offset account because all savings have gone into the house deposit.

So for these first home buyers I would recommend option 1 the Basic Home Loan with no offset account.

If you would like some help understanding if you could save money with offset accounts on your home loan, then please book a free 15min strategy call with me.

You might also like this blog post which covers the 13 games changers for first home buyers, or this one on the 13 step to buy a home.

My advice: Before you sign up to a home loan with all the bells and whistles like an offset account (i) do the calculations to make sure you are better off financially better with it (ii) know how to use it properly to benefit from it.

As a leading refinance broker, Blackk Mortgage Brokers is passionate about helping clients get into the property market and improve their financial wellbeing. Explore our services and book your free consultation with Victor today.

The information contained within this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2023.