A bridging loan allows you to buy the new home while giving you time to sell your current home.

This guide updated for 2025, summarises all you need to know about bridging home loans, and as a bonus, I’ve also included three other approaches to financing the purchase of your next home.

Imagine you are driving around the neighbourhood and just happen to see a beautiful home you really want to buy.

It is a unique property in the right street, with its charming colonial style renovations, more space and a landscaped yard and pool.

Whilst you haven’t been out house hunting every weekend, you have kept your eye out for homes around this area for a while waiting for a property like this to come along.

It’s convenient for your kids schooling and being commutable to work, this is the home you have been waiting for!

You do not want to miss out here so timing is key.

But how do you make an offer to buy and put down a deposit right now, when all your savings / equity sits in your current home loan?

This is where a bridging loan can help.

What is a bridging loan?

Mortgages, bridging loans—what are they? Can I refinance a bridging loan? Questions! Read on for clarity

A bridging loan allows you to borrow the money for the new home, while giving you between 6 to 12 months to sell your current home. Once your current home is sold, the proceeds of the sale are used to pay down the overall debt.

So in other words, a bridging loan covers the gap for when you have bought your new home but have not sold your current home.

Finance options for buying your next home.

Before we go into bridging loans in more detail, I want you to know that there are other ways to finance approaching your next home. Bridging finance is the most common, with majority of our clients using it, but it may not be suitable for you.

- Bridging loans;

- Selling and buying at the same time;

- Sell you current home first, then rent it back from the new owner to give you time to buy your new home’

- Keep your existing home as an investment property.

How does a bridging loan work

Having a bridging loan is like having two home loans, for the period of time between when you own both homes.

During the period between when you have purchased your new home, and you still own your existing home, you’ll make repayments on both your bridging loan and your existing home loan.

Once you sell your existing home, the equity or proceeds will pay out your original mortgage, and any additional money will go towards reducing the mortgage on your new home.

As you are repaying two home loans, we will work with you to make sure your budget can handle repayments on both loans.

Your bridging loan will have interest only repayments (meaning you won’t be repaying any of the loan down) until your home is sold and you have just the one home loan again.

Victor in the Burleigh Heads office. You can also see Victor at our South Brisbane office.

Upsides of a bridging loan

- Buy the home you want now so you don’t miss out – especially the case if the property you are looking at is unique, it is a good deal or if market prices are increasing;

- Get 6 to 12 months to sell your old home (depending on the lender) – get the best price and gives you the chance to fix up small things around house’

- Do one move instead of two – less stress and save one the cost of moving;

- Because rates are low at the moment, a bridging loan is fairly reasonable (would try to avoid bridging loans if rates were 17%).

Downsides of a bridging loan

- Making repayments on two loans at the same time – if don’t have enough buffer it can leave you stretched;

- You need to sell your existing home within the time frame set by the lender with whom you have your bridging loan with – typically this is 6 to 12 months.

Bridging finance helps you finance your move from one home into the next. ?@shaunlockyer

Your bridging loan needs to be with your current home loan lender

As you are essentially using the equity in your current property to cover the deposit and buying costs of the new property, the bridging loan needs to be with the same lender as your current home loan.

This may not be an issue for you at all, however it is a good idea to talk to us about it before buying your next home as you may have some restrictions on what you do.

Some of the main policy restrictions are:

Time frame to sell

Some banks only give you 6 months to sell your current home, where as others give you 12 months.

Amount of equity required

Some banks will require you to have at least 20% of your own equity (including buying costs), where as others only require you to have 5% of your own.

Don’t offer bridging loans

And some banks don’t do bridging finance at all.

Use a Bridging Finance Broker to understand your banks bridging loan policies early on

I would recommend coming to see us at least 3 to 6 months before you buy your new home.

We can let you know if your current lender is the most suitable for you, or if you need to consider refinancing (switching) to another lender.

Many banks/lenders need you to have been with them for at least 3 months, before they will approve you for bridging finance.

How a bridging loan works when you are buying your next home.

While you are hunting around for your next family home, come and see us so we can narrow down your search by giving you a price range for what we calculate you can afford to spend on your new home.

We will meet with you face to face (or over Skype if you prefer) to discuss:

- Realistically, how much you think your current home is worth and how long you think it will take to sell;

- How much you can afford to spend on new property;

- How much equity we think you can get from the sale of your property.

Armed with these facts, you can now confidently make an offer on the home you can see your family living in.

Before you sign the contract of sale, you will need to check in with us as the terms in your contract will be dependent upon your bridging loan. For example, we would normally recommend you allow double the time for getting your home loan approved.

Bridging loan lenders: Steps to approval.

At this point, you will also need to begin the process for getting your bridging loan application underway.

If you choose to use Blackk Mortgage Brokers, then we will have you complete our secure and intuitive online fact find, where you provide all your details required to apply for a loan. A part of this process is uploading supporting paperwork like bank statements and payslips to our secure online portal.

Once this is done, we review your information and recommend which banks / lenders have the most suitable home loans for you. We handle all the paperwork for the home loan application on your behalf and submit it to the lender for approval.

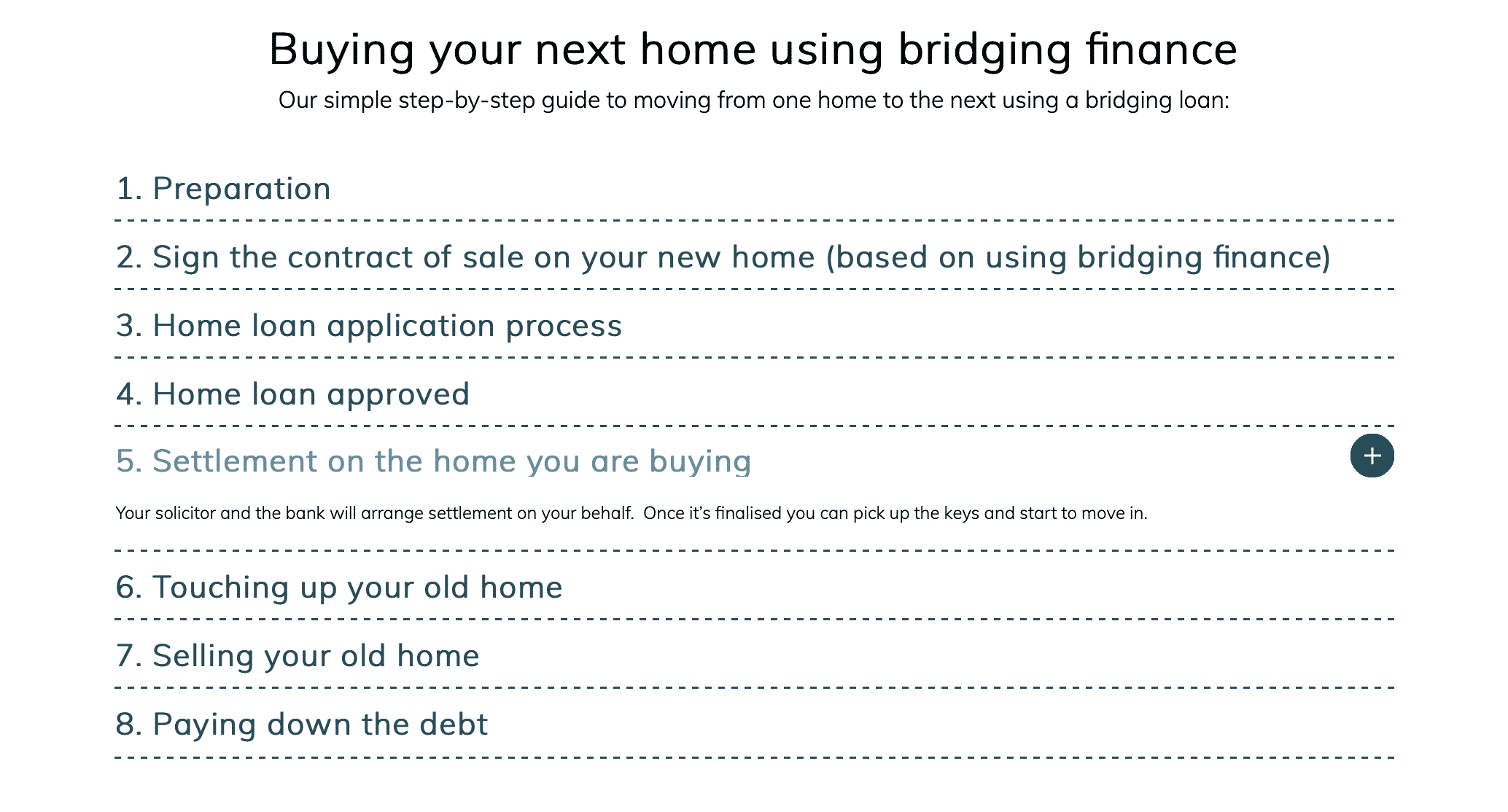

For more on the steps to buy your next home using bridging finance, see this step by step guide.

See the interactive step by step guide on how to buy your next home using bridging finance.

Can I Use a Bridging Loan for Renovation?

Yes, you can use a bridge loan for renovations. Yes, you an finance renos with a bridging loan.. They typically have terms of 1 to 24 months with flexible repayment options, but ensure you have a clear exit strategy for repayment.

The next big step is getting your existing home on the market. Depending on the lender we go with for your finance, you may have up to 12 months to sell your current home. Of course during this ‘gap’, you will be making repayments on the bridging loan and your existing home loan, so you will need to weight up the benefits of how long you take to sell.

Some clients take the opportunity to touch up their existing home with some paint or landscaping, for example, so they can get a higher sale price. Once your property has sold, you will be able to use the proceeds to pay down your overall debt.

As a leading refinance broker, Blackk Mortgage Brokers is passionate about helping clients get into the property market and increase their investment holdings. Explore our services and book your free consultation with Victor today.

The information contained within this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2023.