Reduce Your Home Loan with Expert Advice

There will be a collective sigh of relief from Australian mortgage holders if the predicted interest rate drop goes ahead in the coming months. After so many rises, households are begging for relief, and they may well get it. So with that in mind, now is a great time to fine-tune your mortgage structure and reap as many benefits as possible when the good times are rolling.

As a seasoned mortgage broker with deep knowledge of the current Australian interest rate landscape, there’s a lot I can tell you about how to reduce your home loan repayments in 2025.

With the RBA cash rate currently at 4.35% and predictions from major banks suggesting potential cuts later this year (and you can see this is coming as in the past 3 months banks have started reducing their fixed interest rates – particularly for loan terms between 2 and 4 years) it’s crucial to be proactive in optimising your home loan strategy to prepare for these fluctuations.

How to Reduce Your Mortgage Repayments: 3 Ways

- Negotiate with Your Current Lender

Don’t underestimate the power of negotiation. With interest rates expected to potentially decrease in the latter half of 2025, lenders are keen to retain valuable customers. Contact your lender and request a rate review. If you’ve been a reliable borrower, you may be surprised at their willingness to offer a more competitive rate. - Consider Refinancing

With the average owner-occupier variable rate at 6.37%, there’s potential for significant savings by refinancing. Look for lenders offering rates below this average. Even a 0.5% reduction can translate to substantial savings over the life of your loan. - Utilise Offset Accounts and Extra Repayments

If your loan features an offset account, maximise its use. Every dollar in your offset reduces the interest calculated on your loan. Additionally, making extra repayments now, while rates are higher, can significantly reduce your principal and future interest payments. While this won’t directly reduce your repayments today, it can help you pay off the loan quicker which then reduces the term of the loan (saving you interest overall).

Remember, the key to navigating the current interest rate environment is staying informed and proactive. While we may see rate cuts in the latter part of 2025, it’s crucial to position yourself favourably now. Every borrower’s situation is unique, and what works for one may not be ideal for another.

Read below for a deep dive into the best strategies for getting that mortgage repayment down and preparing for future fluctuations.

In June 2022, I spoke to Channel Nine News on ways to get ahead of interest rate rises.

Mortgage Reduction Strategy 1: Optimizing Your Home Loan in a Changing Market

This strategy is tailored for homeowners who:

- An owner occupied home loan; AND

- Are currently on a variable rate OR are exiting a fixed-rate term within the next 4-6 weeks

- Possess more than 20% equity in their property

Key benefit:

By securing a lower interest rate now, you’re better positioned to weather potential rate fluctuations in the future.

With the average owner-occupier variable rate currently at 6.24% (as of January 2025), there’s significant potential for savings through refinancing. Many lenders are offering rates below this average, with some as low as 5.69%. Even a 0.5% reduction could lead to substantial savings over your loan’s lifetime.

Now could be an opportune time to refinance to a more competitive variable rate home loan. Major banks, including the Big 4, are offering some of the most attractive variable rates we’ve seen in recent years, likely in anticipation of potential rate cuts later in 2025.

Switching to a lower variable rate now allows you to create a financial buffer as we navigate through the current economic climate. While those on variable home loans are more exposed to RBA rate changes, the potential for rate cuts in 2025 could work in your favor.

It’s crucial to note that while experts predict rate cuts in 2025, the timing and extent remain uncertain. Therefore, securing a competitive rate now could provide both immediate savings and long-term benefits.

Before making a decision, consider consulting with a mortgage broker to explore all available options and ensure the refinance aligns with your financial goals13.

Based on a $700,000 loan, with an LVR of less than 70% (as at 16 June 2022).

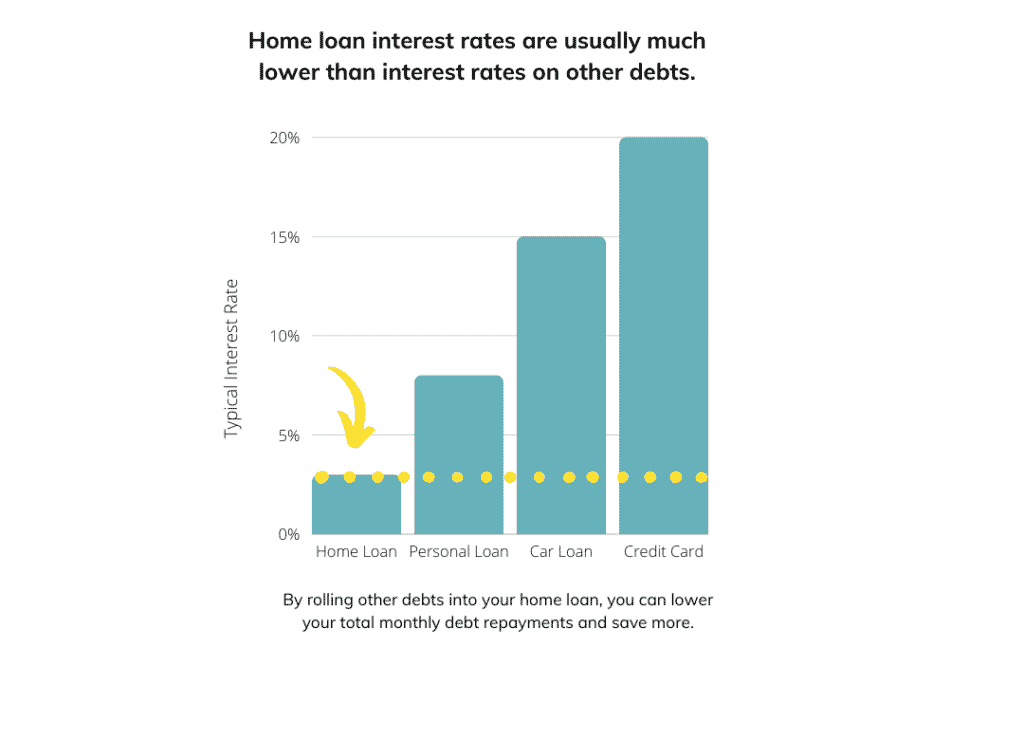

Mortgage Reduction Strategy 2: Roll your debts into your home loan to save money.

This strategy is for you if you have:

- An owner occupied home loan; AND

- At least one or more other debts such as a credit card, car loan, personal loan, etc; AND

- You want to stay with your current bank, OR if you are refinancing you want to borrow less than 80% of the value of your home

Key benefit:

- This can save you money and improve your cash flow each month by lowering your total monthly debt repayment.

- Based on the assumption that we roll all debts into your home loan as it will have the lowest interest rate.

If you are looking for the most effective way to reduce your monthly expenses so you can save more, then rolling some or all your debt payments into your home loan might be the right strategy for you.

I see a lot of family budgets and I can tell you that it is quite common that the biggest fixed expenses each month are debt repayments.

Home loans, car loans and a maxed out credit card often can be the biggest chunk of fixed expenses.

As interest rates rise again, you may find yourself starting to feel concerned about how you will be able to afford all your monthly loan repayments.

The reason why this strategy saves you money is that you are likely paying a much higher rate of interest on your car loan, personal loan and credit cards – than you are on your home loan.

It is often that in terms of debt the lowest rate of interest is on your home loan.

By consolidating these loans into one loan (your home loan) it can reduce the amount of interest that you pay to the lenders overall and it also frees up your cash flow.

Read the full post here including how we saved one family $280 a week using this debt consolidation strategy.

Mortgage Reduction Strategy 3: Optimizing Investment Property Loans in the Current Economic Climate

This strategy is tailored for property owners who have:

- An owner-occupied home loan AND

- An investment property home loan AND

- Your paying principal and interest repayments on both loans

- An interest-only period ending in the next 4-6 weeks that needs renewal

Key benefit:

Converting your investment property loan to interest-only can significantly reduce your repayments, potentially by up to half, while maintaining principal and interest repayments on your owner-occupied home loan.

In recent years, with historically low interest rates, rising rents, and a robust property market, many investors expanded their portfolios. It was common to have principal and interest repayments on both owner-occupied and investment loans, effectively reducing debt on both properties while benefiting from lower interest rates associated with principal and interest loans.

However, the landscape is shifting. With the RBA cash rate at 4.35% as of February 2025 and variable rates averaging around 6.24%, the financial dynamics of property investment have changed dramatically. Many properties that were once cash flow positive are now at risk of becoming cash flow negative.

In this evolving economic environment, it’s crucial to reassess your investment strategy. Consider how many more rate rises you can absorb before your property becomes cash flow negative. Switching your investment loan to interest-only can provide a buffer against rising rates by reducing your repayments, potentially by up to half.

While an interest-only loan may have a slightly higher interest rate (currently averaging around 6.60% for investors), the reduction in monthly repayments can significantly improve your cash flow. This strategy allows you to redirect funds towards your owner-occupied loan, which typically doesn’t offer the same tax benefits as an investment loan.

Remember, interest payments on investment properties are generally tax-deductible, making interest-only loans particularly attractive in the current high-interest environment. However, it’s essential to consult with a financial advisor to ensure this strategy aligns with your long-term investment goals and tax situation.

As we navigate through 2025, with potential rate cuts on the horizon but economic uncertainty still on our minds, flexibility in your loan structure can be a valuable tool in managing your property portfolio effectively.

If you think it will be something that helps, please don’t hesitate to get in touch.

You can read the full post here.

My name is Victor Kalinowski and I’m a Brisbane mortgage broker at Blackk Mortgage Brokers, with offices based in West End (Brisbane) and Burleigh Heads (Gold Coast). If you’re interested in getting in touch for some advice, book a call or call us on 07 3122 3628 today, and we’ll devise a mortgage reduction plan specifically for you.

The information contained within this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2023.