Avoiding these 13 mortgage mistakes as a first home buyer in QLD will save you money today and set yourself up for financial freedom tomorrow.

Mistake 1: Thinking you need to wait till you have a 20% deposit saved to buy your first home.

For all first home buyers in Queensland, it would be ideal to have a 20% deposit saved, but the reality is majority successfully buy with between a 5% to 10% deposit saved.

Of course, having a 20% deposit is best as it means you avoid paying an extra fee called, Lenders Mortgage Insurance, however it is not all about the numbers when it comes to buying your first home.

Let’s face it, it is hard to replicate the sense of contentment and independence you get when living in your own home, compared with say, renting or living with your parents.

And let’s not forget any capital gains you can make if you buy sooner.

But you need to weigh up if it’s worth taking more time to save a 20% deposit, versus buying your first home now. Consider:

- Financially – how many years will it take to save a 20% deposit? How do you think house values will change in this time? How much lenders mortgage insurance will you need to pay?

- Emotionally – what does owning your own home right now mean for you? Are you planning / do you have children you want to settle into their own home?

You may have heard that as of January 2020, the Federal Government has launched a new scheme to help first home buyers buy their first home (know as First Home Loan Deposit Scheme) with just a 5% deposit – where the benefit to you, is that you are not paying the Lenders Mortgage Insurance. Read more here on this one.

My advice: You can buy your first home with a 5% to 10% deposit. However you need to weigh up the pro’s and con’s of buying now V saving a 20% deposit to avoid paying Lenders Mortgage Insurance (LMI) .

Victor Kalinowski 🤓, mortgage broker and founder of Blackk specialises in helping Queenslanders to get their first home loan 🧔🏽👩.

Mistake 2: Cutting your house hunt short.

If you want to get a good deal on your first home, then you must look at at least 20 open homes in the suburb you want to live in.

If you do the hard yards, it pays off as you will know exactly how much to offer and what a good deal looks like.

Surprisingly, you will also find that the vendor will not have done this level of research so you are entering into the negotation far wiser than they are.

I see it happen with my own clients and it works.

The open homes you should go to need to be priced approximately within 10% of the price point you are looking at.

For example, if you are looking to buy your first home for $800,000, then look at 20 homes priced from around $700,000 to $900,000.

My advice: Look through at least 20 open homes in the suburb you are wanting to buy your first home in. They should be within a 10% range above and below the price point you are looking at.

We have a 95% success in getting home loans approved 🙌. Oh, and have I mentioned we also guide you through your property search with advice like how to negotiate with a real estate agent to get the best possible price 👌, what to look out for with your building and pest inspection 👁 and signing the house contract 📝.

Mistake 3: Not using the first home buyer grant to boost your deposit.

If you are weighing up whether you should build or buy a home in the Sunshine State, then consider this.

The Queensland State Government gives eligible first home buyers a $15,000 grant to go towards the costs of building a home.

This $15,000 can be added onto the deposit you already have saved – it is a significant booster, wouldn’t you agree?

This extra deposit could mean you have a 20% deposit so you avoid paying Lenders Mortgage Insurance.

Read more on the first home buyers grant.

The other benefit first home buyers get in Queensland is a rebate on their stamp duty. If you spend less than $550,000 on a home (or $250,000 on vacant land) you could be eligible for a rebate.

You also might find this handy. I spoke to SBS radio recently about the pro’s and con’s of building V buying a home.

As of January 2020, the Federal Government is offering support for first home buyers where you only need a 5% deposit saved – you can read my thoughts on this scheme here.

My advice: If you are looking at building a home, I recommend you add the $15,000 first home buyers grant to your savings to boost your deposit. If you are not building, consider the first home buyers stamp duty rebate.

If you are building a home, you may be eligible for the $15,000 QLD first home buyers grant.

Mistake 4: Having less than a 10% deposit saved means it’s likely you’ll pay a higher interest rate.

The other downside of not having a big enough deposit is it is likely you will pay higher interest rates on your home loan.

This normally starts to become really noticeable when you have less than a 10% deposit to contribute.

Banks have analysed their customer data and can conclude that people with a house deposit of 10% or less are a greater risk of not being able to repay their home loan. So they make you pay higher interest rates.

What many people do not realise is that you can negotiate with the bank to get a lower interest rate.

Interest rates offered on your home loan, are actually ‘priced’ individually for you.

We, as mortgage brokers, negotiate everyday on behalf of our clients to get lower interest rates.

The rate you are offered is based on a number of factors:

- How much you borrow – the more you borrow the bigger the ‘discount’ you can get (like buying in bulk)

- How much deposit you have V how much you borrow (known as ‘loan to valuation ratio’ or LVR) – a bigger deposit means you get a bigger ‘discount’ (a bigger deposit increases the banks buffer and reduces their risk).

If you would like to talk about how you can get into to your first home sooner – and importantly – have your home loan set up to gain from all the good stuff shared in these 13 game changers – then book a call (it’s free).

My advice: Always negotiate on your home loan interest rate (or have us do this for you). If you have more than a 10% house deposit you will get a better rate versus having less than a 10% deposit.

You can buy your first home with a 5% deposit saved 💫.

Mistake 5: First home buyers being unaware of ‘bad marks’ against their credit file.

Your credit history is very important.

I would even say that it’s one of your most important assets.

So before you apply for a home loan you should find out what is on your credit file / rating.

In most cases, you will know if you have a mark against your name – it is often from an unpaid bill – it could be from a phone company, an electricity bill or for an old credit card or personal loan. If you’ve been in this situation it’s likely you would have received some threatening letters / emails or phone calls after getting final notices to pay.

If you do have a less than ideal credit file, you can still borrow money.

However you will find that the conditions around your loan are a lot more restrictive and costs and interest rates are often a lot higher.

You can get your credit file from these two sites:

- Dun and Bradstreet – takes three business days to get the file

- Equifax: – within 2 weeks.

My advice: Get a copy of your credit file 6 months out from buying a home. This gives you enough time to deal with any issues so you can still buy a home. With the right advice and planning, a lot of these problems can ‘go away’.

The money you could save by following this advice might go towards landscaping and a pool 🏊♀️?

Mistake 6: Taking out a home loan with the same bank that mum and dad use.

If you consider your parents to be good role models when it comes to managing money, then chances are you have spoken to them about your decision to buy a home.

Your parents may have been with their bank for many years and have paid off their mortgage on time every month. They may even have a bunch of term deposits or their superannuation with the bank.

Unfortunately, this good behaviour shown by your parents will not benefit you in any way.

I have never seen or heard of anyone benefiting from their family name when getting a home loan.

Nope. Not once.

The risk of only talking to your parents bank is you are severely limiting your options because the bank will only show you their suite of two or three home loans.

In a market where there are hundreds of home loans, you may not get the most suitable home loan for your personal situation. You risk:

- Reducing how much you can borrow;

- Paying more in fee’s;

- Paying a higher interest rate;

- Paying more in interest repayments to the bank;

- Taking longer to repay your home loan.

My advice: talk to your parents bank as well as two to three other lenders to see which home loan is best suited to you.

Victor and the team will research home loans from multiple banks on your behalf to find what will work best for your personal and financial situation 🔎.

Mistake 7: Not speaking to an expert who knows how to reduce Lenders Mortgage Insurance.

If you decide to buy now without your 20% deposit saved, then you need to pay Lenders Mortgage Insurance (LMI).

When it comes to money, you should always seek the advice of an expert. For this task, have a mortgage broker analyze ways to reduce how much LMI you are paying.

You could save thousands of dollars right here, right now.

The key thing is this… there are hotspots where if you have the right deposit amount and a few other factors, then you can save thousands of dollars when you go to buy a home.

It is worth knowing that these LMI hotspots are a bit of an unknown in the home loan industry. If your broker isn’t talking about it, then chances are they may not even be aware of this little nugget of gold.

Read more here on how we went about saving our clients $2,816 by reducing their lenders mortgage insurance.

My advice: See an experienced mortgage broker and ask them to analyse different scenarios for you to find the LMI hotspots. This could save you several thousands of dollars right now.

Lenders Mortgage Insurance is a ‘blessing’ in that it allows you to buy a home with less than a 20% deposit. However it is a substantial additional cost of buying a home. You can probably reduce it by having a mortgage broker analyse your finances👌.

Mistake 8: First home buyers borrowing too much money.

Take a moment to guess what one of the most googled topics is around buying a home and taking out a loan?

It is “how much can I spend on a home?”

There is usually a big difference between how much you can spend and how much you should spend.

Banks have been notorious for lending people more money than they can afford to actually repay – and this is especially the case for first home buyers.

Typically, first home buyers are:

- Couples without kids;

- Both working full time;

- With low fixed expenses (i.e. the ones you can’t change like rent);

- And high discretionary spending on clothing, holidays and eating out etc.

So their combined income is high, especially if they have been promoted over the years – and their fixed expenses are at their lowest.

This is why it is tempting to borrow more than you can afford.

My advice: Avoid spending too much money when you buy your first home. Remember, it is a starter home, not your forever home.

Maybe one day 🤩. Your first home is your starting point so it may not look like this beauty 🌈.

Mistake 9: Underestimating how expensive life gets.

When it comes to working out how much you can afford to spend on a home, you need to consider what you can comfortably repay – long term – on your home loan, as life changes.

It can be hard to budget for the month ahead, let alone years down the track.

You may start a family, take a long overseas holiday or start a business – all of these impact your income, expenses and ability to repay your mortgage.

If you are planning to have children, you need to consider your ability to make the loan repayments when the primary care giver takes time off work to raise the baby 👶. During this time, income is lower and expenses are higher.

It is impossible to know in advance what it truly costs to raise a baby – medical bills, clothing, prams, toys, nappies, cots, activities and the rest.

Some couples go on to have a second or third baby within a few years:

- You now need a bigger car to fit the family, which means car loan repayments;

- More expenses for 2 or 3 or more children;

- A parent takes time off to raise the baby so income drops;

- It goes on….

Make sure you can still afford your home loan repayments as life changes down the track, like when you grow your family. Raising kids is more expensive than you think 👶🧒🏻👧🏼👩🧔🏽🐶🐱🐠.

What happens when you can’t afford to make loan repayments?

This is where some people start to draw down on the equity in their home loan (their savings).

And they also take out extra credit cards and personal loans – which I strongly advise against (see mistake #13).

The decision is often made for the parent on maternity leave, to go back to work sooner then planned, or to take on extra work to ease the financial squeeze.

It’s usually 2-5 years after buying their first home when they get to this point of being under a lot of stress financially.

They call us asking.. “what can we do”?

Unfortunately, in these situations – where people have taken on extra credit cards, personal loans and have fallen behind on home loan repayments – the choices they have are typically difficult and painful ones (think ‘selling the home or car’ type choices).

Back to today…

When you are floating in the bubble of getting your first dream home and both of you are earning an income, it can be hard, if not impossible, to forsee the expenses that lay ahead.

My advice is – instead of asking “how much can we spend / borrow”…

A better way of thinking about it is to ask these two questions:

- How much do we feel comfortable in repaying each week / fortnight / month for the long term?

- What is likely to happen in our future and how is this likely to impact us financially?

My advice: Be very realistic (even conservative) about what you can comfortably afford to repay each month over the long term. Make sure you use the time before your financial position changes, to build up your savings.

Your first home is also your children’s first home where their first memories will be 👶🐶💞.

Mistake 10: First home buyers paying for an offset account on your home loan which is not being utilised.

It is very common for people to have heard from friends or parents that ‘offset accounts’ are the go these days as they help you save on interest repayments.

It is true – they do – but only under the right circumstances.

Offset accounts are great when you are borrowing a lot of money, and for those with a big chunk of savings or equity in their home.

Unfortunately most first home buyers don’t fit this profile.

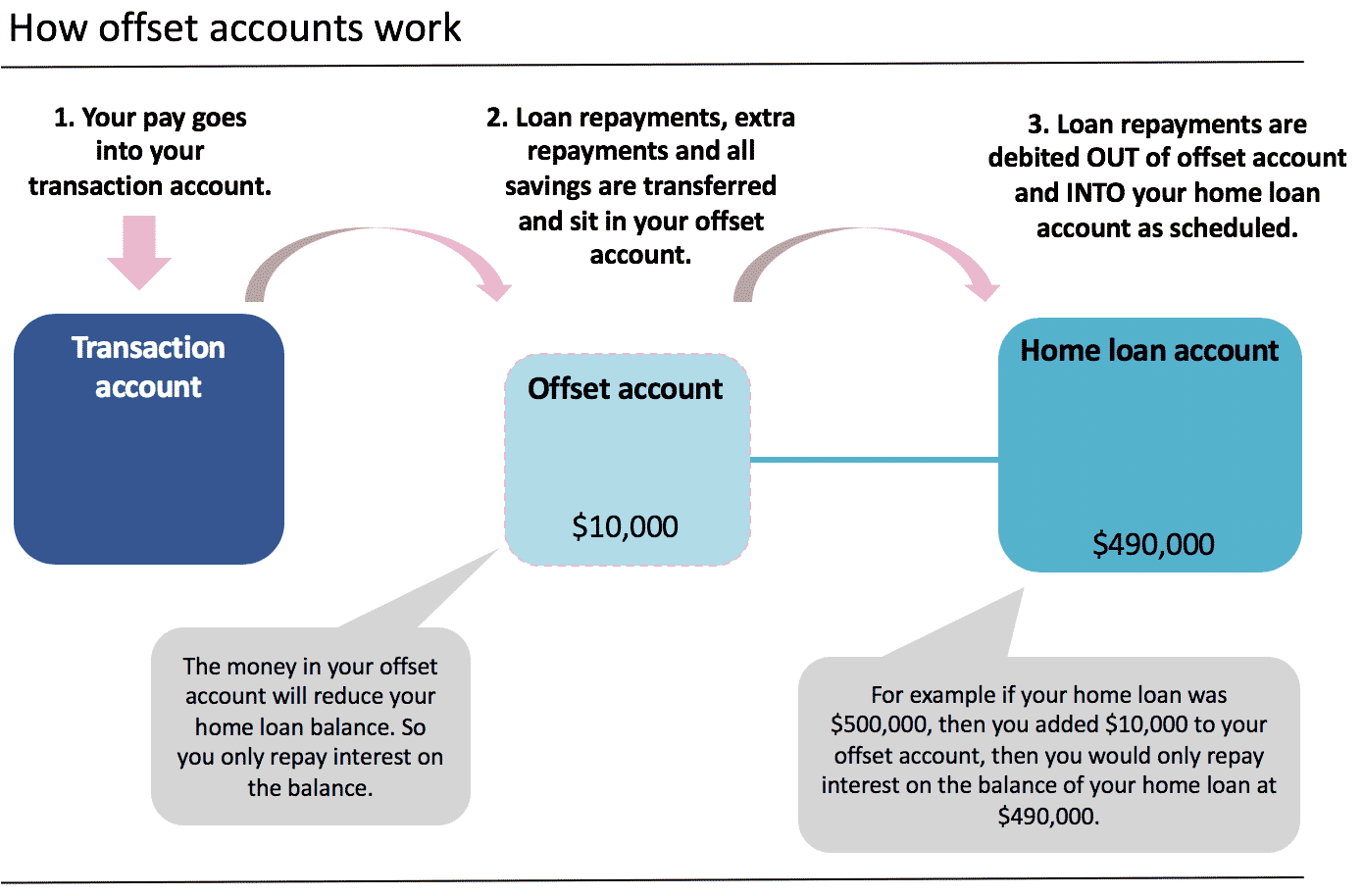

Table 1: Offset accounts save you money by reducing the balance of your home loan.

Having a home loan with an offset account may mean that you pay an annual fee of several hundred dollars a year and you may have a higher interest rate on your home loan.

So you need to understand if you are financially better off – or not – paying for this offset account.

The cost to someone who makes this mistake can range from hundreds to many thousands of dollars a year.

Read more here on how we calculated if this client should pay for an offset account (answer: in this case, no, she was better off not having one ).

If you would like to talk about how you can get into to your first home sooner – and importantly – have your home loan set up to gain from all the good stuff shared in these 13 game changers – then book a call (it’s free).

My advice: Before you sign up to a home loan with all the bells and whistles like an offset account (i) do the calculations to make sure you are better off financially with it, and (ii) know how to use it properly to benefit.

Amanda in the Blackk Mortgage Brokers office 📟.

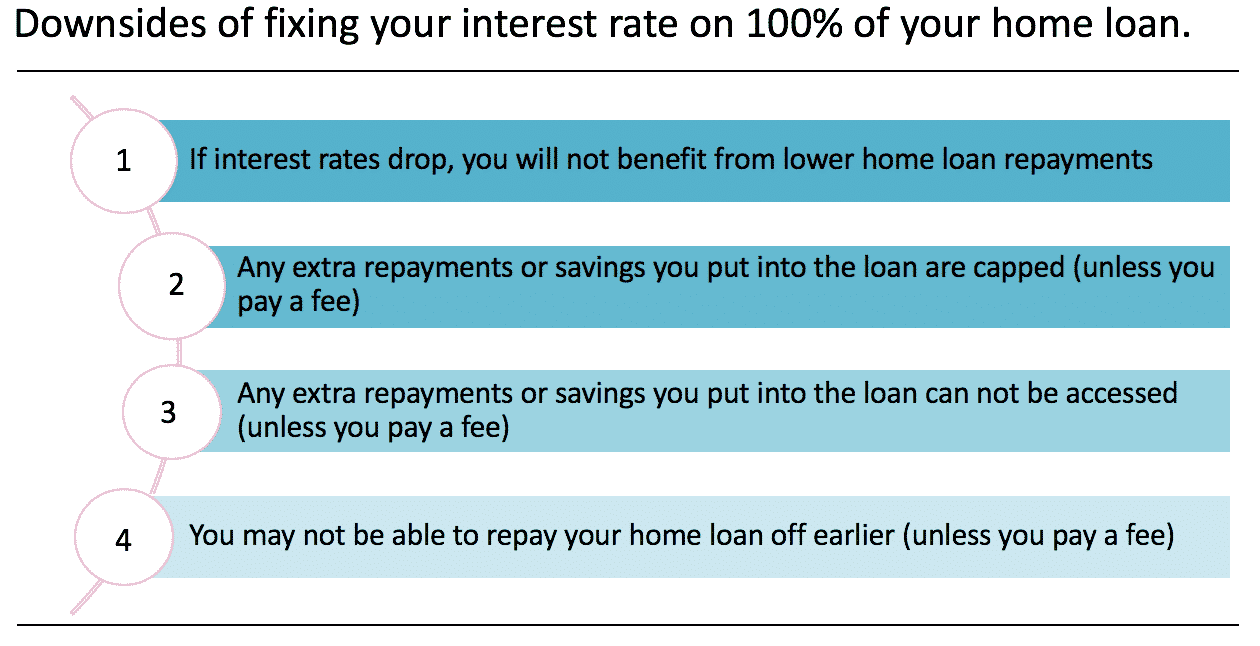

Mistake 11: Fixing the interest rate on your entire home loan so you pay more interest.

If there is one thing I am sure of after working in banking for most of my life, it is this – you can not beat the banks at their own game.

If you think you will save money or beat the system by fixing your interest rate… then you will be very disappointed.

Banks offer fixed interest rates, as it is often in their benefit to lock you in – not yours.

In my experience, if you are on a reasonable variable rate, it is unlikely that by choosing a fixed rate you will save money over staying variable.

I personally have fixed my home loan rate three times in the last 20 years, and each time, I would have been better off staying with a variable interest rate.

Table 2: Fixing the interest rate on 100% of your home loan removes all flexibility so I do not recommend it. If you must fix your rate, then do so on only a portion of your home loan for a period of time. This is called ‘splitting’ your loan.

If you do need to fix your interest rate, do it on only a portion of your home loan for a period of time.

This is almost always a better option than fixing the entire home loan.

Read more here on how this client paid an extra $1,973 in one year in interest repayments because they fixed the interest rate on their entire home loan.

My advice: Choose the right home loan for your personal circumstances and never fix the interest rate on 100% of your home loan. Something seemingly simple can impact you in a big way.

Get to know these 13 most important game changers to perfect your home loan. We’ve made it pretty simple to take in 🐶.

Mistake 12: Not having a plan to pay off your home loan sooner.

You should always be paying off more on your home loan than your minimum loan repayment – even if it’s just $20 a week.

I think this is a non negotiable commitment.

More importantly, if you feel you CAN’T afford $20 a week extra, then perhaps you’re not ready to get a home loan in the first place?

How much of a difference do extra repayments make?

A lot actually.

Consider this.. the average first home buyer has a home loan of $450,000 so the minimum repayment each week is $511 (based on principle and interest repayments at a variable rate of 4.25% over 30 years).

Over 30 years, the average first home buyer would repay the bank $345,860 in interest repayments – this is a HUGE amount, wouldn’t you agree?

If instead they repaid an extra $150 every week for the life of the loan (new repayment is now $666 = $511 + $150), these first home buyers would pay off their home loan almost 11 years sooner and save $138,474 in interest paid. Take a look at the table below for more.

Making Extra Repayments on Your Home Loan Makes a Big Difference

Table 3: Quite possibly the most important table you will see in your life if you want financial freedom. Paying off more than your minimum weekly repayment will mean you save huge amounts in interest repaid to the bank. Imagine what else you could do with all that money (based on $450,000 home loan on principle and interest repayments at a variable rate of 4.25% over 30 years)? 🏎🚁⛵️🏖🏦💎

So if you desire financial freedom later in life (aka live and spend freely), then make the commitment now, while you are young, to reduce your home loan as much as possible.

It is why every client I work with receives their own personal plan to repay their mortgage faster .

Read more here on how paying off your home loan sooner is one of the single most important actions you can take to move towards being wealthy later in life.

My advice: always repay more on your home loan than the minimum monthly repayment. Even better, have a plan to pay it off in 15 years or less.

Knuckle down now and pay off your mortgage to reap the rewards in years to come 💎🌈. An architecturally designed home in the future, like this one, is within reach with a clever home loan strategy 🤩😜.

Mistake 13: Taking out car / personal loans and credit cards once you have your home loan.

As a mortgage broker, we talk to people in a lot of different situations – some are getting ahead financially while other people are sadly, in terrible situations.

I have observed over the years that almost everyone in a terrible financial situation will be struggling with both a home loan AND multiple personal loans / credit cards / interest free accounts.

By the time these debts are paid each month there is not a lot of money left to live on – this is an extremely stressful situation for anyone to be in.

Something like this can really put you behind financially and I’ve seen situations where it’s taken first home buyers years to recover from a set back like this.

If you would like to talk about how you can get into to your first home sooner – and importantly – have your home loan set up to gain from all the good stuff shared in these 13 game changers, please book a 15min strategy call with me now.

My advice: Avoid taking on extra debt like car loans and credit cards within a few years of buying your first home. If you really need to do so, come and talk to me first to see if there is a better option financially.

The information contained within this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2023.