Fixing your entire home loan interest rate will cost you more.

In 2025, Australian home loan rates remain a bit of a challenge for borrowers, with fixed and variable rates still pretty high. Many homeowners are exploring strategic loan management to help reduce costs. Instead of fixing your entire home loan, we recommend a split loan approach.

By dividing your mortgage into fixed and variable portions, you can:

- Hedge against potential rate fluctuations

- Maintain some flexibility in repayment strategies

- Reduce overall financial risk

- Access different features across loan segments

A split loan allows you to protect a portion of your mortgage from immediate rate increases while keeping options open for potential future refinancing or additional repayments.

This nuanced approach gives you the flexibility to adapt to rate fluctuations in what is currently a fairly complex lending environment.

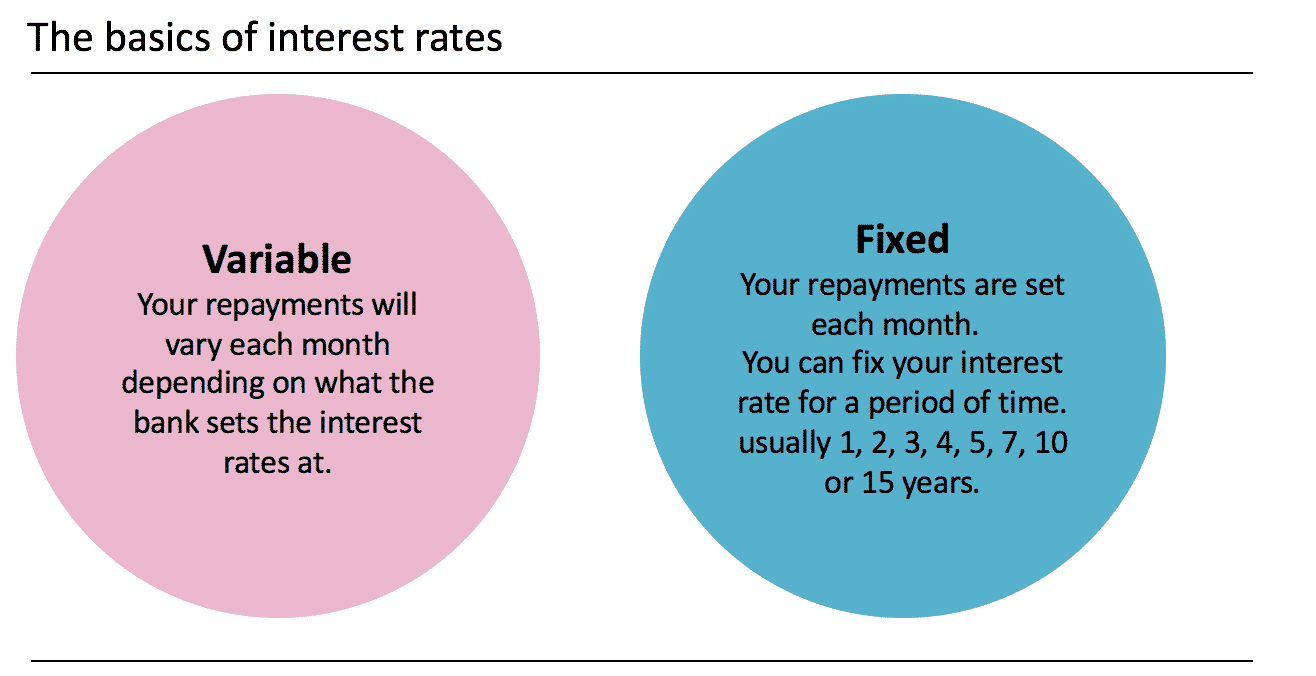

Fixed-rate loans offer stability and predictable repayments, making them ideal for borrowers who value certainty, especially in a fluctuating interest rate environment. They provide protection against rate increases but may limit flexibility in making extra repayments.

Variable rate loans offer more flexibility with features such as redraw facilities, offset accounts, and the ability to make extra repayments without penalties. They also provide opportunities for savings when rates drop but come with the risk of higher repayments if rates increase.

Experts are predicting interest rate cuts in 2025, with major banks forecasting the cash rate to potentially drop to 3.35% by December 2025. Luckily for homeowners, anticipation of rate cuts is driving competitive variable rate offerings, making it an opportune time to consider a split loan strategy.

Remember, the right choice depends on your individual financial goals, risk tolerance, and market conditions. Consulting with a mortgage broker can help you make an informed decision tailored to your specific circumstances.

Let’s take a detailed look at the variable vs fixed loan game.

Victor Kalinowski, mortgage broker at Blackk Home Loans. We have offices in West End (Brisbane) and Burleigh Heads (Gold Coast).

Be aware, you can’t beat the banks at their own game

If there is one thing I am sure of after working in banking for most of my life, it is this..

You can not beat the banks at their own game.

What I mean is, if you think you will save money or beat the system by fixing your home loan interest rate… then you will be very disappointed.

Banks offer fixed interest rates, as it is often in their benefit to lock you in – not yours.

The bankers who are setting the fixed interest rates, are also setting the variable interest rates, meaning they are calculated together to make the banks a profit.

In my experience, if you are on a reasonable variable rate, it is unlikely that by choosing a fixed rate you will save money over staying variable. I personally have fixed my home loan interest rate three times in the last 20 years, and each time, I would have been better off staying with a variable interest rate.

If you want to talk about how to choose which interest rate to go with, you can book a free 15min strategy call with me.

What is the difference between a fixed or variable home loan?

Table 1: Interest rates can be variable, fixed, or a bit of both.

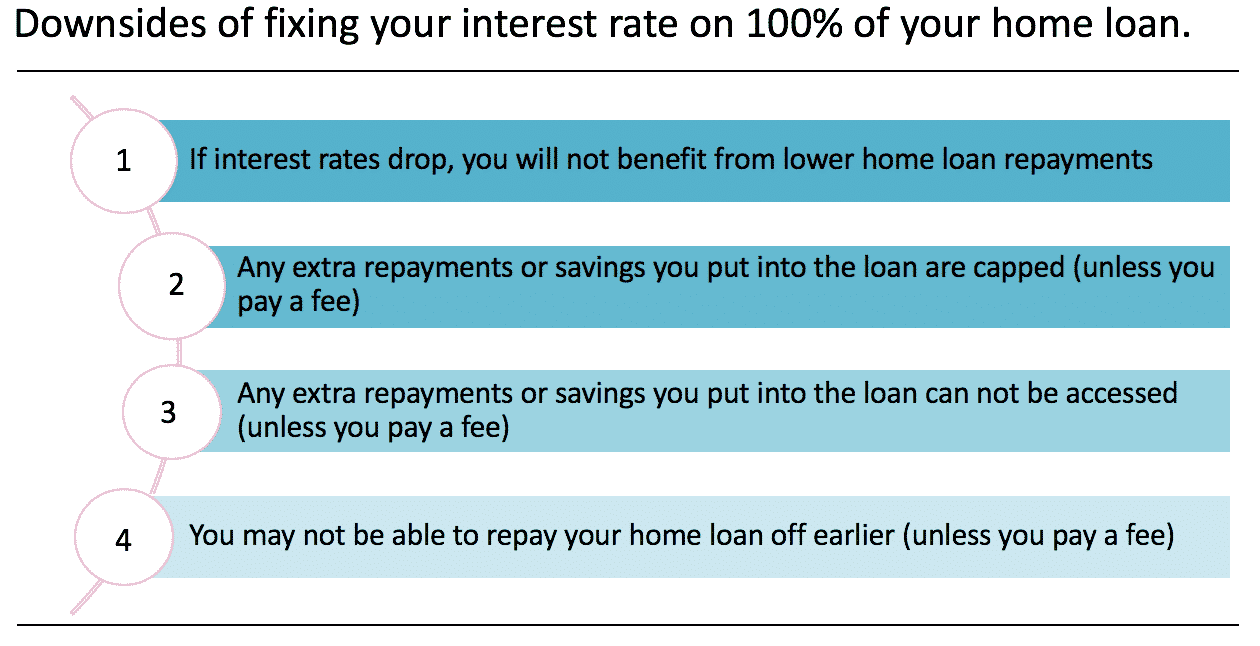

If you need to fix your home loan interest rate, then try a split loan.

There are times when I recommend fixing a portion of your home loan interest rate for a period of time.

It is almost always because you want some certainty, peace of mind and control over your home loan repayments as you know what your outgoings will be.

If you are living off a tight budget for a period of time, then fixing can be beneficial for you.

For example if you are going on maternity leave or taking time off work, you may not be able to afford the extra repayments if home loan interest rates rise – or more likely – you may simply not want to be awake at night stressing about it.

Fortunately, you can choose to fix a portion of your home loan, known as a ‘split’.

For example on a $500,000 loan you might fix the interest rate on $400,000 for a period of 3 years and leave $100,000 on a variable interest rate.

This means 80% of your home loan repayments are set and the remaining will vary.

This is almost always a better option than fixing the interest rate on the entire home loan.

Many of our clients fix between 60% to 90% of their loan and keep the remaining part variable.

This way you can benefit from mostly stable home loan repayments…. plus you can make extra repayments into the variable portion on your home loan and access this money if you need it, without paying a fee.

Take note though, if you want to make extra home loan repayments, you will need an offset account or redraw (they usually come together).

Have a mortgage broker explain how it can work for your situation.

Table 2: Fixing the interest rate on 100% of your home loan removes all flexibility so I do not recommend it. If you must fix your rate, then do so on only a portion of your home loan for a period of time. This is called ‘splitting’ your loan.

Case study: The difference between fixed and variable loan: fixing home loan interest rates cost these Queenslanders $1,973 in one year.

I’ve met with a family who owned a home in McDowall, in Brisbane, which they bought 2 years ago.

This family had $482,000 owing on their home loan, all of which was on a fixed interest rate for a period of three years.

They got their home loan direct with their bank of 11 years.

Their financial situation at the time I met them was as follows:

Table 3 – This family lost close to $2,000 in one year as they fixed their interest rate on their entire loan.

This family signed up to this home loan because the bank said it was their ‘lowest home loan interest rate’.

In other words, this family fixed their interest rate on their entire loan because they thought they were getting a good deal.

What they should have done instead

Because this family were really good savers, they had accumulated $43,000 in savings in the two years they had been living in their new home.

This was sitting in an online high interest saver, earning basically no interest (well $1.24 a week to be more accurate).

Now if instead their home loan had a portion set as a variable interest rate – and they also had either a redraw or an offset account as features – they could have placed the $43,000 into the offset account.

This would have reduced their loan by $43,000 – so their loan repayments would be lower as they only pay interest on the balance of the loan ($482,000 less $43,000).

In fact, having the $43,00 in savings in their offset account for one year would have saved them $1,973 a year in interest (which is about $37.96 per week V less than $2 they were earning in the high interest saver).

So do I go with a fixed or variable home loan?

My advice: Choose the right home loan for your personal circumstances and never fix the home loan interest rate on 100% of your home loan. Something seemingly simple can impact you in a big way.

More on Variable VS Fixed Loans and Other Helpful Advice

If you want to learn more about home loans, start here with this post on the 13 game changers for first home buyers, or this one on when to refinance, or you may prefer this one on the steps to buy a home.

About Blackk Mortgage Brokers

As the founder of Blackk Mortgage Brokers in Brisbane, I’ve dedicated my career to transforming how Australians approach property financing. With over 15 years of experience in the mortgage industry, I established our firm to provide personalised, strategic financial guidance across Queensland. Our team specialises in crafting tailored mortgage solutions for first-time buyers, investors, and families throughout Brisbane, Gold Coast, and the Sunshine Coast.

We pride ourselves on our comprehensive approach, offering access to over 40 lenders and providing transparent, educational support throughout the loan process. My vision has always been to demystify mortgage complexity and empower clients to make confident financial decisions. Whether it’s home loans, investment properties, or refinancing, we’re committed to helping Australians build sustainable wealth through smart property strategies.

Our success stems from understanding each client’s unique financial journey and providing solutions that align with their long-term goals.

Book a call today and speak to Victor about the best way to structure your mortgage. Victor will talk you through how to best tailor your home loan to suit your personal circumstances and how to reduce your mortgage repayments.