To successfully buy a home in the wild 2021 property market, you may just need a Fully Assessed Home Loan Pre Apprroval.

Back before time (before Covid) most of the people I helped to get a home loan approved did not need a Fully Assessed Home Loan Pre Approval.

How times have changed.

In late 2021, the property market is looking very different. With so many buyers, and not enough homes on the market, it has become a very competitive ‘sport’ where only the prepared are winning!

And so my position and advice around the need to get a Fully Assessed Home Loan Pre Approval has changed.

At the moment, about two thirds of the people I help are doing pre approval with us.

In today market, property prices are higher so people are needing to borrow more – a pre approval will help give them certainity that their home loan will be approved.

The other issue we were noticing is that clients were missing out on having their offers accpeted as the winning offer was often a cash unconditional one from a buyer in NSW or VIC.

The standard 3 to 4 week finance clause just does not compete with that. However the 7 to 14 day finance clause you ar able to offer with a Fully Assessed Home Loan Pre Approval will.

In a competitive property market you may need a Fully Assessed home loan pre approval [Victor Kalinowski, mortgage broker at Blackk Mortgage Brokers].

What is a Fully Assessed Home Loan Pre Approval?

A Fully Assessed Home Loan Pre Approval is basically like a practice run for the real thing (i.e. a proper home loan).

We apply for a pre approval with one lender, and you go through all the same steps as you would as if you were getting a formal home loan once you had a home under contract.

The Fully Assessed Pre Approval with one lender will tell you:

- How much money will the bank lend me?

- How much deposit do I need saved?

- How much will my repayments be?

- Approximate interest rate and fees?

It gives you the certainty to go house hunting and make an offer to buy / bid at auction.

How do I know if I need a pre approval or not?

Should I bother with a pre approval or not?

The types of situations where typically people need a home loan pre approval are:

– If you have a low deposit saved, say less than 15% of the purchase price

– If you are buying a property in an area where it’s highly competitve and you’re missing out becuase your finance clause is too long (say 3 weeks plus).

– If you are self employed

– If your fianncial situtaion is more complicated.. for example there are family guarantees or a number of debts, a not ideal credit history etc.

Basically, if you earn a decent income and have a good deposit saved you may not need to do the Fully Assessed Pre Approval.

The best way to determine what is the right way forward for you is to book a free 15minute call with me and I can advise you.

What is the difference between a free online home loan approval and a Fully Assessed Home Loan Pre Approval?

When you should consider a Fully Assessed Pre Approval.

You should consider applying for home loan pre approval if:

- You are buying a home for auction;

- Your financial situation is complicated, especially around how you are paid / where your income comes from – as this impacts how much you can borrow;

- If there is only one lender who would be suitable for you;

- If you are buying your next home and need bridging finance, or using the equity in your home to buy an investment property.

Some examples of a complicated financial situation:

- If you are self employed and;

- Your income comes from your business / trusts / multiple entities;

- Where there are big variations in your income for the last two years;

- There are company debts.

In these situations, different banks will have very different assessments of what your actual income is which will determine how much you can borrow.

What else do I get when I do Fully Assessed Home Loan Pre Approval with Blackk Mortgage Brokers?

- How to improve your borrowing capacity so you can buy a better home

- Best loan structure

- How to manage the steps of making an offer and negotiating.

This advice helps you buy the home you want and ensures your home loan is set up well for the future.

Bank staff simply just do not offer this valuable advice.

Have a look on google or facebook at our reviews to get a feel for how we help.

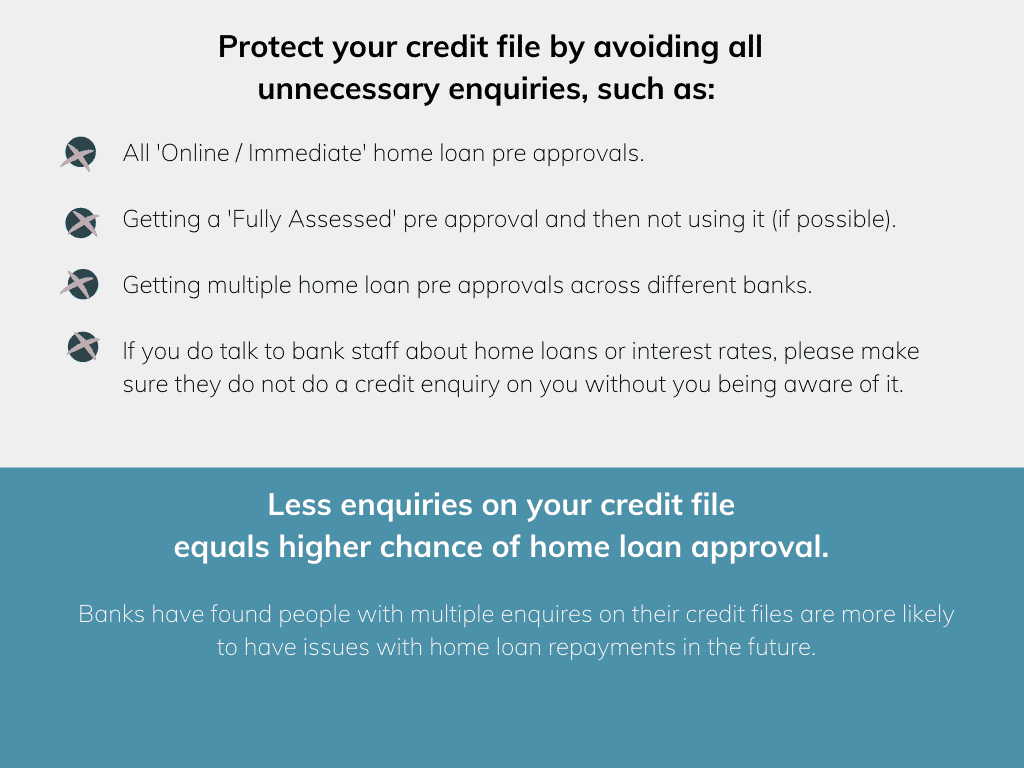

Be aware that if you ask bank staff about home loans, make sure they are not doing a credit check on you as it can effect getting your home loan approved.

What is an ‘Informal’ Home Loan Pre Approval.

An ‘Informal’ home loan pre approval’ can be ok if you:

- Have regular salary / wage;

- Have saved at least a 5% deposit (plus buying costs);

- And are building or buying a home (for sale, not auction);

When we have a client in this situation, I check with a number of different banks on your behalf, ‘informally’.

Meaning I discuss your situation with several banks, like your income, debts and what you want to buy – without providing any identifying information.

This means we can ensure there are no enquires on your credit file which improves your chance of getting your home loan approved when you find the home you want.

I normally ask for your group certificate, last two payslips and bank statements on your savings account which is to verify your situation (however I do not give these to any banks).

You will learn:

- What you can do to improve your situation so you can buy the home you want;

- A range of banks that would be suitable for you to get your home loan through;

- How much deposit you need saved;

- How much you can borrow / spend on a home;

- Approximate interest rates and fees;

- What your buying costs would be.

- Steps to buy a home.

- And no enquiry on your credit file.

Once I have the information from you, it will usually take 1 to 5 days to come back to you with some options and answers.

If you would like to get started understanding what type of pre approval is for you approval, just book a free 15 minute phone call with me and we can discuss how to help.

Victor Kalinowski from Blackk Mortgage Brokers can help with getting the right home loan pre approval.

How do you apply for a Fully Assessed Home Loan Pre Approval?

To apply, you need to complete our detailed online fact find with your personal and financial details, plus provide paperwork like payslips and bank statements.

Once I have received all your information, it will take 5 to 10 business days to get your pre approval done.

In this time, I fully assess your situation and recommend a range of lenders /home loans which would suit you.

Then you sign an application form and it is submitted to the bank for approval.

How long does a Fully Assessed Home Loan Pre Approval last?

When you have a Fully Assessed pre approval, it is valid usually for 90 days, meaning you can buy a home in that time period.

After 90 days, you will need to re apply.

If you buy a home in the 90 days, then we upgrade it to an unconditional approval, and you follow the steps to buy a home from step 9 onwards (sign the contract).

By having a pre approval, you normally can reduce your finance period in the house contract by around 3 business days.

Read more on how a shorter finance period can help in Making an offer on a house below asking price [5 winning strategies in 2020].

What to be aware of with Fully Assessed Pre approvals.

Pre approvals are NOT a 100% guarantee the bank will loan you money

The pre approval is based on exactly what information you provided, so if some of this has changed by the time you go to buy a home, it may not be valid anymore. For example, if you said you had $20,000 in savings, but by the time you come to buy a home, you’ve spent some and you have only $18,000, then it may not longer be valid;

You may miss out on the latest home loan deals like a lower interest rate

By the time you apply for the actual home loan, a new deal (like a lower interest rate or a discount on Lenders Mortgage Insurance) may come out with another bank. You may miss the deal as you do not want to go through the effort of applying again. Deals come out every week and may not be with the bank you have chosen to do your pre approval with;

It’s too pre-emptive to choose a bank when you haven’t bought the actual property

A high property valuation is a factor that determines which bank we recommend for your home loan as it effects how much you can borrow. Property valuations can’t be done until you have the home under contract. So by doing a pre approval, you may end up choosing a bank that does not allow you to borrow as much.

Pre-approvals create an enquiry on your credit file

As mentioned, we aim to preserve your credit file, but sometimes doing a ‘fully assessed pre approval’ is worth it.

Other things that could impact the validity of your pre-approval;

- You resign from your job or you’re made redundant;

- You take on new debts (i.e. credit cards / car loans / personal loans);

- The property that you’re building is valued at a significantly lower amount to what you’re paying for it;

- You have overdrawn your account;

- You pay other loans / debts that you have late;

- If the banks lending policy changes.

If you’d like to talk about your personal situation in more detail, you can book online now, either a phone call or face to face meeting. There is no cost for this consultation.