What is Lenders Mortgage Insurance and how much will it cost? Lenders Mortgage Insurance Explained

Lenders Mortgage Insurance can be a bit tricky to get your head around at first, however it’s an important concept to understand if you are buying a home with less than a 20% deposit saved.

The key point is this – you should always have a mortgage broker analyse your finances to suggest ways to reduce your premium.

It often saves my clients several thousand dollars.

What is Lenders Mortgage Insurance?

If you do not have a 20% deposit saved when you go to buy a home, you will need to pay an extra fee called Lenders Mortgage Insurance (LMI).

LMI is a one off, upfront insurance paid by you, to protect the bank, in case you are unable to repay your home loan.

Fortunately the cost can be added to your mortgage so it won’t come out of your deposit. However it is a significant additional cost of buying a home.

Banks have worked out that those with lower house deposits saved, are at greater risk of defaulting on their home loan. In short, you are seen as higher risk so you end up paying more.

As an example, if you were buying a property for a $500,000, you would need $100,000 saved to avoid paying LMI (so you borrow $400,000). If instead you only had $50,000 saved (deposit of 10%) then you would borrow $450,000. This would means you pay LMI of $9,419.

So as you can see it is a substantial extra cost to wack onto your home loan.

You must have a mortgage broker analyse your finances to suggest ways to reduce your Lenders Mortgage Insurance.

How much will Lenders Mortgage Insurance cost me?

If you decide not to save the 20% deposit and you need to pay Lenders Mortgage Insurance (LMI) instead, then it is crucial you have a (top*) mortgage broker look at ways to reduce your LMI.

Often in life it pays to seek the advice of an expert and reducing LMI, is one of these things.

You could save thousands of dollars right here, right now.

For those interested in getting their heads around it, here are some of the basics:

- The cost of LMI increases as you borrow more;

- But LMI does not increase proportionally, with how much you borrow; and

- If you can’t save 20%, then save a 10% deposit.

The key thing is this… there are hotspots where if you have the right deposit amount and a few other factors, then you can save thousands of dollars when you go to buy a home.

Lenders Mortgage Insurance is payable by you, to the lender, if you buy a home with less than a 20% deposit.

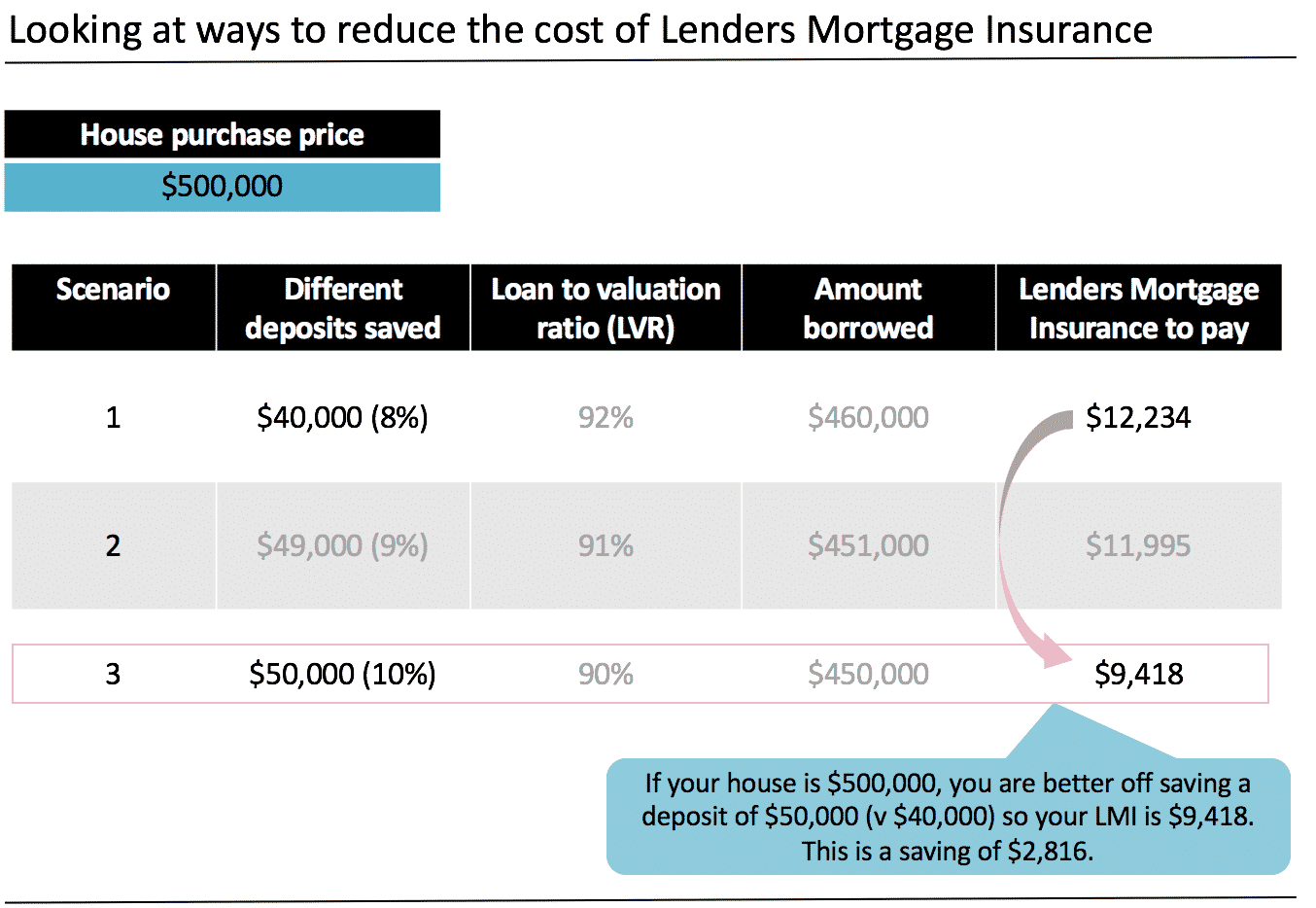

CASE STUDY – How we saved our clients $2,816 by reducing their Lenders Mortgage Insurance

Imagine first home buyers who want to spend $500,000 on a home (see scenario 1 in the table below).

They come to see me with $40,000 saved (8% deposit).

As they don’t have a 20% deposit, they need to pay LMI of $12,234.

Now $12,234 is a lot of money for anyone, not just first home buyers, wouldn’t you agree?

Let’s look at our options to reduce this.

Table 1: To pay less in LMI, muck around with an LMI calculator to find the right balance between your house deposit and how much you borrow.

My advice was they go with option 3, where they would save $2,816 versus their current situation (as shown in scenario 3 table 1):

- Aim to save $50,000 (10% deposit), so they;

- Borrow $450,000 (borrowing 90% of the value of the home);

- So the LMI payable is $9,418;

- This saves them $2,816 compared to their original situation;

- The extra $10,000 saved in deposit reduces how much they borrow.

Ways to Avoid Lenders Mortgage Insurance Explained

LMI Waivers: A Game-Changer for Eligible Borrowers

In 2025, several Australian banks are offering LMI waivers, which can save eligible borrowers tens of thousands of dollars. These waivers are typically available to specific groups such as professionals, high-income earners, and first-time home buyers. Here’s what you need to know:

- Banks offering LMI waivers include NAB, Westpac, ANZ, and CBA.

- Eligibility often depends on your profession and income level.

- Some banks offer waivers for loans up to 95% LVR for certain professions.

- First home buyers may be eligible for waivers with some lenders.

To qualify for an LMI waiver, you typically need to meet specific criteria such as income thresholds and work in a particular professional category. It’s worth exploring these options with a mortgage broker who can help you navigate the various lender policies.

The Home Guarantee Scheme: An Alternative to LMI

For those who don’t qualify for LMI waivers, the Home Guarantee Scheme offers another path to avoid LMI. This government initiative allows eligible first home buyers to purchase a property with as little as a 5% deposit, without paying LMI. Key points include:

- The government provides a guarantee of up to 15% of the property value.

- Eligibility criteria were expanded in 2023, making it accessible to more Australians.

- The scheme has limited places, so it’s important to act quickly if you’re interested.

The Strategic Use of Guarantor Loans

Another way to avoid LMI is through a guarantor loan. This involves a family member, usually parents, using the equity in their property to secure your loan. Benefits include:

- Potential to borrow up to 105% of the property value without paying LMI.

- Can help first-time buyers enter the market sooner.

- May allow for better interest rates and loan terms.

However, it’s crucial to understand the responsibilities and risks for both the borrower and the guarantor before proceeding with this option.

The Importance of Professional Advice

Navigating the complexities of LMI, waivers, and alternative schemes can be challenging. Speak to us at Blakk Finance for expert advice and unique insights. We can:

- Assess your eligibility for LMI waivers or government schemes.

- Compare different lenders and their policies.

- Help you understand the long-term implications of your choices.

Remember, while avoiding LMI can save you money upfront, it’s important to consider your overall financial situation and long-term goals when making decisions about your home loan.

It is also worth knowing that these lenders mortgage insurance hotspots are a bit of an unknown in the home loan industry. If your broker isn’t talking about it, then chances are they may not even be aware of this little nugget of gold.

Read the full post here on Lenders Mortgage Insurance. You may also be interested in these 13 games changers for first home buyers.

Expert Advice from Victor: Reduce Your Mortgage Insurance

My advice: If you want lenders mortgage insurance explained thoroughly, book a call with an experienced mortgage broker like Victor here at Blackk Mortagage Brokers Finance and he will run different scenarios for you to find the LMI hotspots and workarounds. Coupled with his knowledge of the First Home Owners Grant in Queensland, Victor’s LMI expertise could save you several thousand dollars right now.

The information contained within this page is general in nature. It serves as a guide only and does not take into account your personal financial needs. Before you act on this information you should seek independent legal and financial advice. Copyright Blackk Mortgage Brokers 2025.